7th CPC – Revision of pension of pre-1.1.2016 Defence Forces pensioners

No. 17(01)/2017/(02)/D(Pension/Policy)

Government of India

Ministry of Defence

Department of Ex-Servicemen Welfare

New Delhi.

Dated 5th September, 2017

To

The Chief of the Army Staff

The Chief of the Naval Staff

The Chief of the Air Staff

Subject- Implementation of Government’s decision on the recommendations of the 7th Central Pay Commission (CPC) – Revision of pension of pre-1.1.2016 Defence Forces pensioners/ family pensioners etc.

Sir,

The undersigned is directed to say that the Seventh Central Pay Commission (7th CPC), in its Report, recommended two formulations for revision of pension of pre-2016 Armed Forces pensioners. A Resolution No 17(1)/2014/D(Pension/Policy) dated 30.9.2016 was issued by this Ministry indicating the decisions taken by the Government on the various recommendations of the 7th CPC on pensionary matters.

2. Based on the decisions taken by the Government on the recommendations of the 7th CPC, orders for revision of pension in respect of pre-1.1.2016 Armed Forces pensioners/ family pensioners in accordance with second formulation were issued vide this Ministry’s letter No 17(01)/2016-D(Pen/Pol) dated 29.10.2016 and modified vide letter No 17(01)/2017(01)/ D(Pen/Pol) dated 4th September 2017 for revision of Pension/ Family pension. It was provided in the letter dated 29.10.2016 that the revised pension/ family pension with effect from 1.1.2016 in respect of pre-1.1.2016 Armed Forces pensioners/ family pensioners shall be. determined by multiplying the pension/ family pension as had been drawn on 31.12.2015 by the factor of 2.57.

3. In accordance with the decisions mentioned in this Ministry’s Resolution No 17(1)/2014/D(Pension/Pol) dated 30.9.2016 and letter No 17(OI)/2016-D(Pen/ Pol) dated 29.10.2016, the feasibility of the first formulation recommended by the 7th CPC has been examined by the Committee headed by Secretary, Department of Pension & Pensioners’ Welfare.

4. The aforesaid Committee has submitted its report and the recommendations made by the Committee have been considered by the Government. Accordingly, it has been decided that revised pension/ family pension of all Armed Forces Personnel who retired/ died prior to 1.1.2016, shall be revised by notionally fixing their pay in the pay matrix recommended by the 7th CPC in the level corresponding to the pay in the pay scale/ pay band and grade pay at which they retired/ died. This will be done by notional pay fixation under each intervening Pay Commission based on the formula for revision of pay. The revised rates of Military Service Pay, Non Practicing Allowance, where applicable, and ‘X’ Group pay & Classification Allowance for JCO/ORs, if applicable, notified in terms of 7th CPC orders, shall also be added to the amount of pay notionally arrived at under the 7th CPC pay matrix and shall be termed as notional reckonable emolument as on 1.1.2016. While fixing pay on notional basis, the pay fixation formulae, approved by the Government and other relevant instructions on the subject in force at the relevant time, shall be strictly followed.

Calculation of Pensionary benefits under first formulation

5. Subject to Para 9, the rates of revised pension/ family pension in terms of these orders shall be determined as follows :-

5.1 The revised Retiring/ Service/ Special/ Invalid/ Ordinary/ Mustering out Pension, Service element of Disability/ Liberalised Disability/ War Injury Pension shall be 50% of the notional reckonable emoluments arrived at as per Para 4 above.

5.2 The revised Disability element/Liberalized disability element of Disability/ Liberalized Disability Pension shall be 30% of the notional reckonable emoluments arrived at as per Para 4 above. The revised War Injury element of War Injury Pension shall be 60% and 100% of the notional reckonable emoluments arrived at as per Para 4 above in cases of release and invalided out cases respectively. The rates so determined shall be for 100% disability and shall be reduced pro-rata subject to degree of disability accepted and for the period notified in the PPO.

Note – The aggregate of service element and liberalized disability element shall not be less than 80% of the notional reckonable emoluments.

5.3 Where an Armed Forces personnel was discharged/ retired under the circumstances mentioned in Para 4.1 of this Ministry’s letter No 1(2)/97/D(Pen-C) dated 31.1.2001 with disability including cases covered under this Ministry’s letter No 16(5)/2008/D(Pen/Policy) dated 29.9.2009 & dated 19.5.2017 and the disability/war injury had already been accepted as 20% or more, the extent of disability or functional incapacity shall now be determined in the manner prescribed in Para 7.2 of said letter dated 31.1.2001 for the purpose of computing disability/ war injury element with effect from 1.1.2016. Rates for calculation of disability where composite assessment is made due to existence of disability, as well as war injury, shall be determined in terms of provision contained in Para 3(b) of Ministry’s letter No. 16(02)/2015-D(Pen/Pol) dated 8th August 2016.

5.4 The revised enhanced rate and normal rate of Ordinary Family pension shall be 50% and 30% respectively, of the notional reckonable emoluments arrived at as per Para 4 above for the applicable period of grant.

5.5 The revised Special Family pension shall be 60% of the notional reckonable emoluments arrived at as per Para 4 above for the applicable period of grant.

5.6 The revised Liberalized Family pension shall be equal to the notional reckonable emoluments arrived at as per Para 4 above for the applicable period of grant.

5.7 For child/children of Armed Forces personnel in receipt of Liberalized Family pension, the revised Liberalized Family pension shall be 60% of the notional reckonable emoluments arrived at as per Para 4 above for the applicable period of grant.

5.8 The revised Dependent Pension (Special) shall be 50% of notional Special Family pension arrived at in terms of provisions as at Para 5.5 above. The Liberalized Dependent Pension (Liberalized) shall be 75% (in case both parents are alive) and 60% (in case of single parent/dependent brother/sister) of notional Liberalized Family pension arrived at in terms of provisions as at Para 5.6 above.

5.9 The revised Second Life award of Special Family pension in case of JCO/OR including NCs(E) shall be 50% of notional Special Family pension arrived at in terms of provisions as at Para 5.5 above. The revised Second Life award of Liberalized Family pension in case of JCO/ORs including NCs(E) shall be 60% of notional Liberalized Family pension arrived at in terms of provisions as at Para 5.6 above.

Note —1 : The amount of revised pension/family pension arrived at in terms of this Para, shall be rounded off to the next higher rupee.

Note – 2 : In cases where the family pension has been divided amongst more than one beneficiary, the revised family pension for beneficiaries all together shall not exceed the applicable rate of family pension indicated above.

6. It has also been decided that higher of the two formulations i.e. the pension/ family pension already revised in accordance with this Ministry’s letter No 17(01)/2016- D(Pen/Pol) dated 29.10.2016 and modified vide letter No 17(01)/2017(01)/D(Pen/Policy) dated 4th September 2017 or the revised pension/ family pension as worked out in accordance with Para 5 above, shall be granted to pre-1.1.2016 Armed Forces pensioners as revised pension/ family pension with effect from 1.1.2016. In cases where pension/ family pension being paid with effect from 1.1.2016 in accordance with this Ministry’s letter No. 17(01)/2016-D(Pen/Pol) dated 29.10.2016 happens to be more than pension/family pension as worked out in accordance with Para 5 above, the pension/ family pension already being paid shall be treated as revised pension/ family pension with effect from 1.1.2016.

7. Instructions were issued vide this Ministry’s letter No. 1(3)/98/D(Pen/ Ser) dated 27.5.1998 for revision of pension/ family pension in respect of Commissioned Officers who retired or died prior to 1.1.1986, by notional fixation of their pay in the scale of pay introduced with effect from 1.1.1986. The notional pay so worked out as on 1.1.1986 was treated as average emoluments/ last pay for the purpose of calculation of notional pension/ family pension as on 1.1.1986. The notional pension/ family pension so arrived at was further revised with effect from 1.1.1996 and was paid in accordance with the instructions issued for revision of pension/ family pension in implementation of the recommendations of the 5th CPC. However, in the case of Pre-1.1.1986 JC0s/ORs, no such notional fixation of pay was prescribed and revision of their pension was based on pension tables provided in this Ministry’s letter No 1(2)198/D(Pen/Ser) dated 14.7.1998.

8. Accordingly, for the purpose of calculation of notional pay with effect from 1.1.2016 of those Commissioned Officers who retired or died before 1.1.1986, the pay scale and the notional pay as on 1.1.1986, as arrived at in terms of the instructions issued vide this Ministry’s letter No. 1(3)/98/D(Pen/ Ser) dated 27.5.1998, shall be treated as the pay scale and the pay of the concerned Commissioned Officer as on 1.1.1986. In the case of those Commissioned Officers who retired or died on or after 1.1.1986 but before 1.1.2016, including all pre-1.1.2016 JC0s/ORs, the actual pay and the pay scale from which they retired or died would be taken into consideration for the purpose of calculation of the notional pay as on 1.1.2016 in accordance with Para 4 above.

9.The ceiling of minimum and maximum pension from 1.1.2016, prescribed under Para 5.4 of this Ministry’s letter No 17(01)12016-D(Pen/Pol) dated 29.10.2016 and further clarified vide Para 6 of letter No 17(01)/2017(01)/D(Pen/Pol) dated 4th September 2017 shall continue to be applied on the revised pension/ family pension determined under this order.

10.The pension/ family pension as worked out in accordance with provisions of Para 5 and 6 above shall be treated as ‘Basic Pension’ with effect from 1.1.2016. The revised pension/ family pension includes dearness relief sanctioned from 1.1.2016 and shall qualify for grant of Dearness Relief sanctioned thereafter.

11. The existing instructions regarding regulation of dearness relief to employed/ re-employed pensioners/ family pensioners, as contained in this Ministry’s letter No 7(1)195/D(Pen/Services) dated 28.8.2000 and Department of Pension & Pensioners Welfare OM No 45/73/97-P&PW(G) dated 2.7.1999, as amended from time to time, shall continue to apply.

12. The pension of the pensioners who are drawing monthly pension from the Defence Forces on permanent absorption in Public Sector Undertakings/ Autonomous Bodies shall also be revised in accordance with these orders. However, separate orders will be issued for revision of pension of those pensioners who had earlier drawn one time lump sum terminal benefits on absorption in Public Sector Undertakings etc., and are drawing 43% / 45% restored pension in case of Commissioned Officers and JC0s/ORs respectively as per the instructions issued by this Ministry from time to time.

13. In cases where, on permanent absorption in Public Sector Undertakings/ Autonomous Bodies, the terms of absorption and/ or the rules permit grant of family pension under the orders issued by this Ministry, the family pension being drawn by the family pensioners or already sanctioned in her favour shall also be updated in accordance with these orders.

14. The quantum of age-related pension/family pension available to the old pensioners/ family pensioners shall continue to be as follows:-

| AGE OF PENSIONER/FAMILY PENSIONER | ADDITIONAL QUANTUM OF PENSION |

|---|---|

| From 80 years to less than 85 years | 20% of revised basic pension/ family pension |

| From 85 years to less than 90 years | 30% of revised basic pension /family pension |

| From 90 years to less than 95 years | 40% of revised basic pension /family pension |

| From 95 years to less than 100 years | 50% of revised basic pension /family pension |

| 100 years or more | 100% of revised basic pension /family pension |

The amount of additional pension shall be shown distinctly in the pension payment order. For example, in case, where a pensioner is more than 80 years of age and his/ her revised pension is Rs10,000 pm, the pension shall be shown as (i) Basic pension = Rs.10,000 and (ii) Additional pension = Rs 2,000 pm. The pension on his/ her attaining the age of 85 years shall be shown as (i) Basic Pension = Rs 10,000 and (ii) additional pension = Rs.3,000 pm. Dearness Relief will be admissible on the additional pension available to the old pensioners also.

Note:- The additional pension/ family pension available to pensioners of 80 years of age and above shall be applicable in the case of disability/ war injury element / Liberalized Disability element of disability /liberalized Disability/ War Injury Pension also.

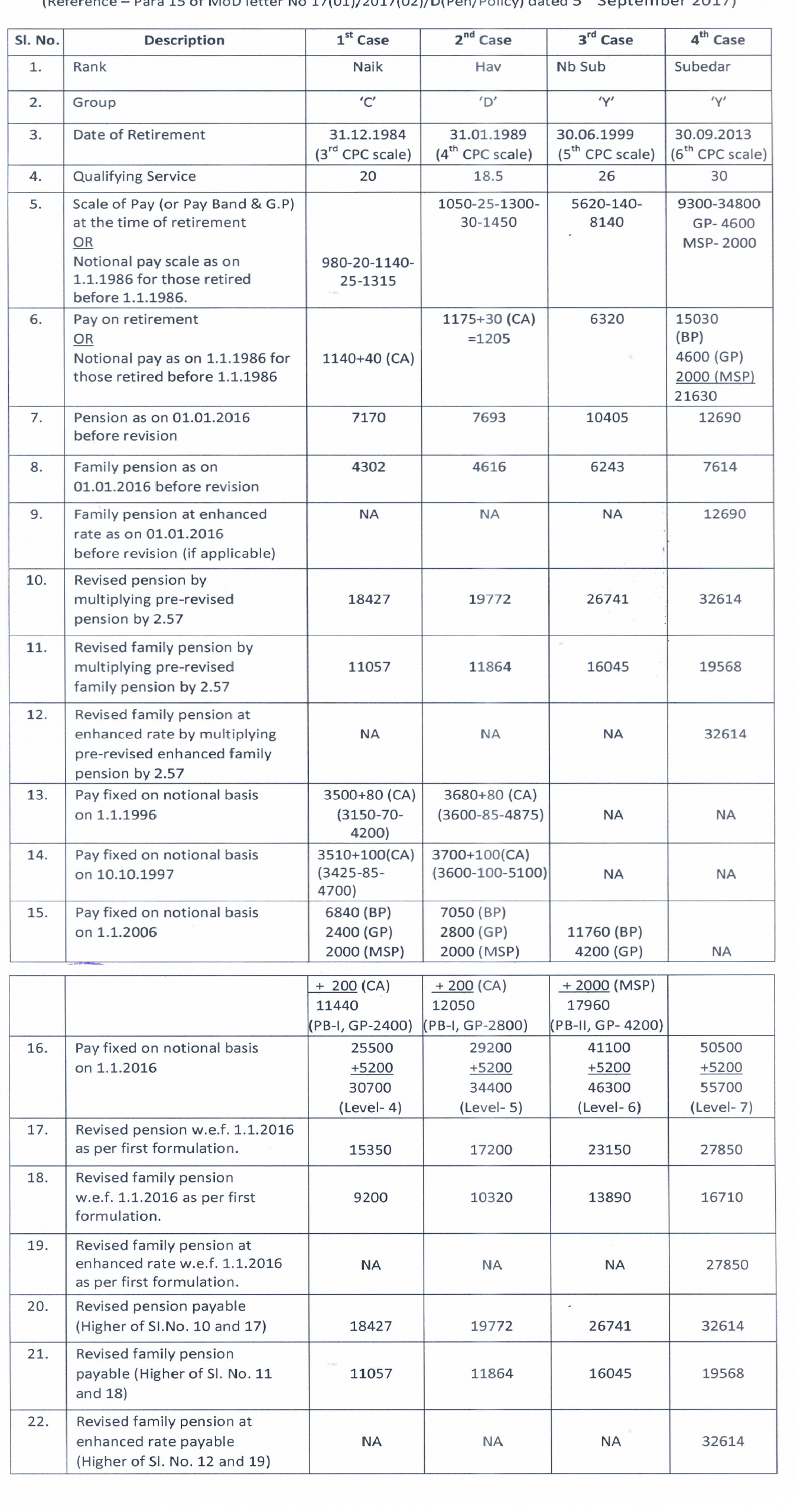

15. A few examples of calculation of pension/family pension in the manner prescribed above are given in Annexure-I to this letter.

MISCELLANEOUS INSTRUCTIONS

16. No arrears on account of revision of Pension/ Family pension on notional fixation of pay shall be admissible for the period prior to 1.1.2016. The arrears on account of revision of pension/ family pension in terms of these orders would be admissible with effect from 1.1.2016. For calculation of arrears becoming due on the revision of pension/ family pension on the basis of this letter, the arrears of pension and the revised pension/ family pension already paid on revision of pension/ family pension in accordance with the instructions contained in this Ministry’s letter No 17(01)/2016-D(Pen/Pol) dated 29.10.2016 shall be adjusted. Any overpayment of pension coming to the notice or under process of recovery shall be adjusted in full by the Pension Disbursing Agencies against arrears becoming due on revision of pension on the basis of these orders. In case of a pensioner to whom the benefit accrues under the provisions of this letter has died/dies before receiving the payment of arrears, the Life Time Arrears of pension (LTA) shall also be paid as per extant orders.

17. No commutation of pension will be admissible on amount of pension accruing as a result of revision of pension under these orders. However, the existing amount of pension, if any, that has been commuted will continue to be deducted from the revised pension while making disbursement till the applicable period of deduction. Notional fixation of pay in terms of these orders will also not affect the entitlement of retirement gratuity already determined and paid with reference to rules in force at the time of discharge/ invalidment/death.

18. It shall be the responsibility of the concerned Record Offices and attached Pay Account Offices in case of JC0s/ ORs of the three Services and :PCDA(0) Pune/ AFCAO New Delhi/ Naval Pay Office, Mumbai in case of Commissioned Officers of Army/ Air Force/ Navy to initiate cases for revision of pension/ family pension of pre-1.1.2016 pensioners/ family pensioner with effect from 1.1.2016 in accordance with these orders for issue of revised Pension Payment Order (PPO) for every pensioner/ family pensioner. The Pension Sanctioning Authority would impress upon the concerned Record Office/ PCDA(0) Pune / AFCAO New Delhi / Naval Pay Office, Mumbai for fixation of pay on notional basis based on extant orders and will issue revised Pension Payment Authority at the earliest. Detailed instructions for initiation of revision cases shall be issued by PCDA(P) Allahabad to all concerned immediately after issue of this order. The revised PPO shall be issued by the Pension Sanctioning Authorities directly to concerned Pension Disbursing Authority for effecting prompt payments as a special measure. The remaining copies of PPOs shall be dispatched by PSAs in usual manner.

19. These orders shall apply to all Pre-1.1.2016 Armed Forces pensioners/ family pensioners drawing pension/ family pension under the corresponding Pension Regulations and various Government orders issued from time to time. A pensioner/ family pensioner, who became entitled to pension/ family pension with effect from 1.1.2016 consequent upon retirement/death of Armed Forces personnel on 31.12.2015, would also be covered by these orders. These orders shall, however, do not apply to UK/HKSRA pensioners, Pakistan & Burma Army pensioners and pensioners in receipt of monthly Ex-gratia payments.

20. This issues with the concurrence of Ministry of Defence (Fin/Pension) vide their Part file (1) to (30)(01)/2016/Fin/Pen dated 14th August 2017.

21. Hindi version will follow.

Yours faithfully

S/d,

(Manoj Sinha)

Under Secretary to the Government of India

ANNEXURE- I

EXAMPLES (JCOs/ORs)

(Reference — Para 15 of MoD letter No 17(01)/2017(02)/D(Pen/Policy) dated 5th September 2017)

[download id=”105221″ template=”dlm-buttons-button”]

Leave a Reply