7th CPC Pay Calculator Updated with Bunching Benefits

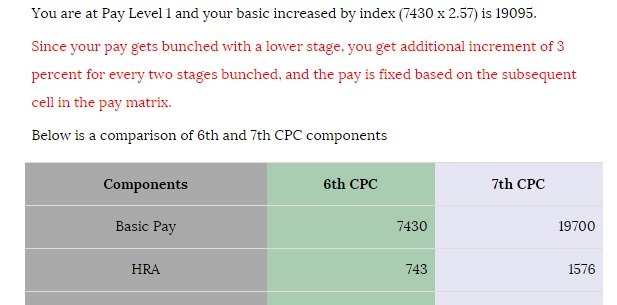

As per the 7th CPC recommendation regarding bunching benefits as described in page No 80 (extracted the stanzas for your reference below), we have updated the calculator to help you calculate the pay with bunching benefits. The calculator will now show an additional note highlighted in red if you are eligible for the bunching benefits based on the below description (sample image attached below).

5.1.36 Although the rationalisation has been done with utmost care to ensure minimum bunching at most levels, however if situation does arise whenever more than two stages are bunched together, one additional increment equal to 3 percent may be given for every two stages bunched, and pay fixed in the subsequent cell in the pay matrix.

5.1.37 For instance, if two persons drawing pay of ₹53,000 and ₹54,590 in the GP 10000 are to be fitted in the new pay matrix, the person drawing pay of ₹53,000 on multiplication by a factor of 2.57 will expect a pay corresponding to ₹1,36,210 and the person drawing pay of ₹54,590 on multiplication by a factor of 2.57 will expect a pay corresponding to ₹1,40,296. Revised pay of both should ideally be fixed in the first cell of level 15 in the pay of ₹1,44,200 but to avoid bunching the person drawing pay of ₹54,590 will get fixed in second cell of level 15 in the pay of ₹1,48,500.

sample image

Click Here-7th CPC Pay Calculator Updated with Bunching Benefits