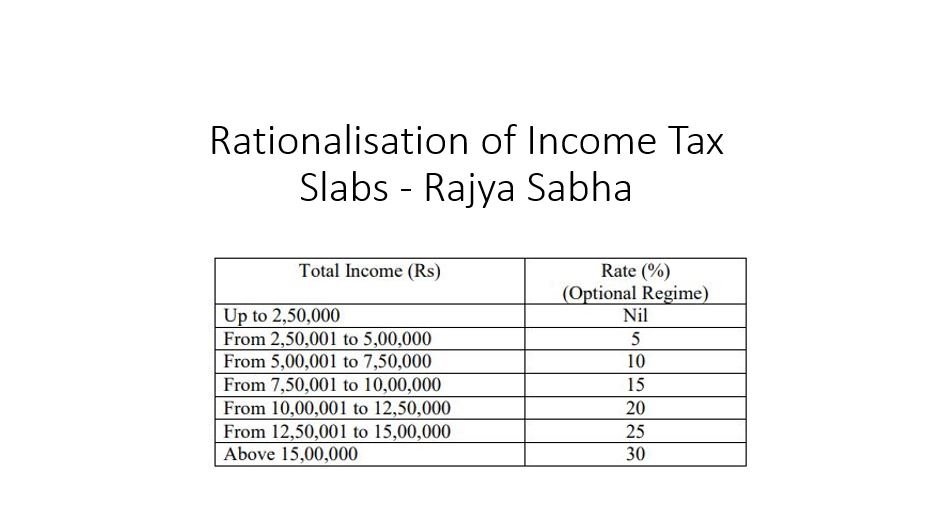

Finance Bill 2023 – Rate of Income taxes

The provisions of Finance Bill, 2023, relating to direct taxes seek to amend the Income-tax Act, 1961, to continue reforms in direct tax system through tax reliefs, removing difficulties faced by taxpayers and rationalization of various provisions.