Special package – LTC cash voucher scheme

Due to Covid-19 pandemic and lockdown, Our India’s growth in the fourth quarter of the fiscal year 2020 went down to 3.1% according to the Ministry of Statistics. It has led to the global economic slowdown that affects day today life of the people. so Central government employees are not in a position to avail themselves of LTC for travel to any place in India or their hometowns in the current block of 2018-21.

In order to boost them, our Government has decided to provide a special package for central government employees in lieu of LTC fare with some conditions. Under the LTC cash voucher scheme, cash equivalent to LTC-consisting of leave encashment and the fare of the entitled LTC may be paid by way of reimbursement, if an employee opts for this in lieu of one LTC in the block of 2018-21.

An Overview:

This special package is valid during the current financial year till 31st March 2021. An amount up to 100% of leave encashment and 50% of the value of deemed fare may be paid as advance into the bank account of the employee which shall be settled based on the production of receipts towards purchase and availing of goods and services.

The claims under this package (with or without advance) are to be made and settled within the current financial year. Non-utilization / under-utilization of advance is to be accounted for by the DDOs in accordance with the extant provisions relating to LTC advance, for example,

“Immediate recovery of full advance in the case of non-utilisation and recovery of an unutilized portion of the advance with penal interest”

The cash equivalent may be allowed if the employee spends a sum 3 times of the value of the fare under the category of business class(Rs. 36,000), Economy class(Rs. 20,000) of airfare and Rail fare of any class(Rs. 6,000).

View also: Finmin Order: LTC Special cash package during the Block 2018-21 : Important FAQ

Employees those who are opting for this scheme are required to buy goods/ services worth 3 times the fare and one time the leave enhancement before March 31st 2021, and cash must be spent on goods attracting GST of 12% or more from a GST registered vendor through digital mode. The employee has to submit GST invoice to the employer for verification to claim the benefit. In case the employee spends a lower amount, the total amount payable would be reduced accordingly.

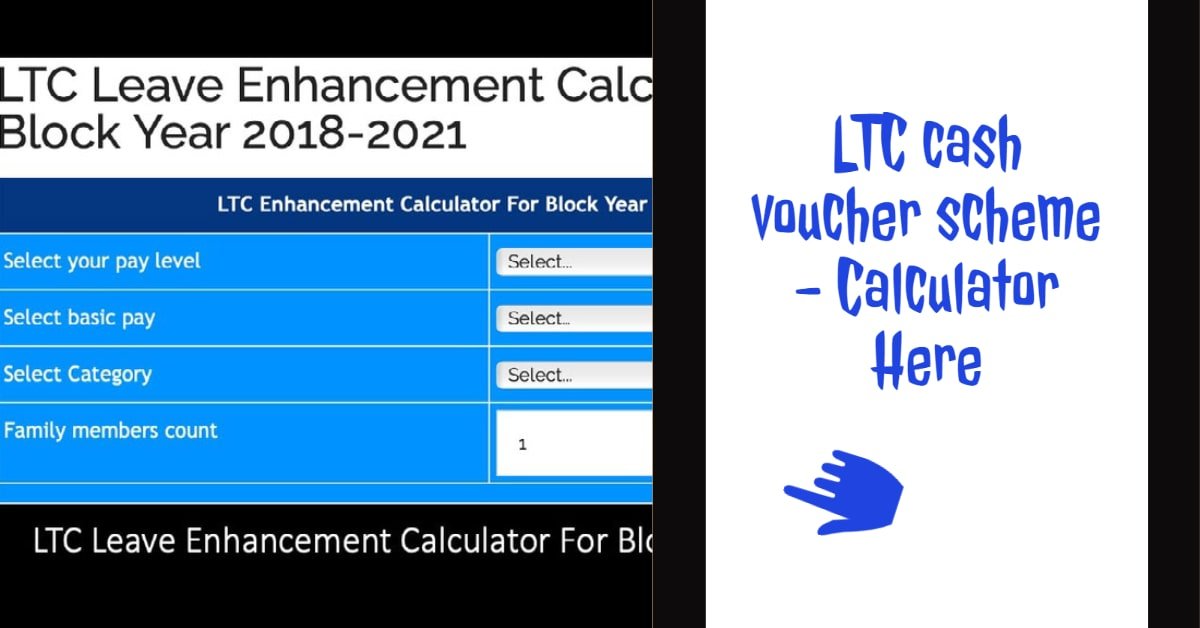

Here is a calculator to compute Central Government employee’s special package