Pay Revision of Board level and below Board level Executives and Non-Unionised Supervisors of CPSEs

No. W-02/0028/2017-DPE (WC)-GL-XIII/ 17

Government of India

Ministry of Heavy Industries and Public Enterprises

Department of Public Enterprises

Public Enterprises Bhawan

Block No. 14, C. G. O. Complex,

Lodhi Road, New Delhi-110003

Dated: 3rd August, 2017

OFFICE MEMORANDUM

Subject:-Pay Revision of Board level and below Board level Executives and Non-Unionised Supervisors of Central Public Sector Enterprises (CPSEs) w.e.f. 01.01.2017.

The last revision of the scale of pay of Board level and below Board level Executives and Non-Unionized Supervisors of Central Public Sector Enterprises (CPSEs) was made effective from 01.01.2007 for a period of 10 years. As the next Pay Revision became due from 01.01.2017, the Government had set up the 3rd Pay Revision Committee (PRC) under the chairmanship of Justice Satish Chandra (Recd.) to recommend revision of pay and allowances for above categories of employees following IDA pattern of pay scales with effect from 01.01.2017. The Government, after due consideration of the recommendations of the 3rd PRC have decided as follows:

2. Revised Pay Scales: – The revised Pay scales for Board and below Board level executives would be as indicated in Annexure-I. There will be no change in the number and structure of pay scales and every executive has to be fitted into the corresponding new pay scale. In case of CPSEs which are yet to be categorized, the revised pay scales as applicable to the Schedule `D’ CPSEs would be applicable.

3. Affordability: The revised pay scales would be implemented subject to the condition that the additional financial impact in the year of implementing the revised pay-package for Board level executives, Below Board level executives and Non-Unionized Supervisors should not be more than 20% of the average Profit Before Tax (PBT) of the last three financial years preceding the year of implementation.

Fitment Benefit:

i. In case additional financial impact in the year of implementing the revised pay-package of a CPSE is within 20% of average PBT of last 3 years, a uniform full fitment benefit of 15% would be provided.

ii. If the additional financial impact in the year of implementing the revised pay-package is more than 20% of the average PBT of last 3 Financial Years (FYs), then the revised pay-package with recommended fitment benefit of 15% of BP+DA should not be implemented in full but only partly, as per the part-stages recommended below:-

|

Part stages |

Additional financial impact of the full revised pay package as a % of average PBT of last 3 FYs |

Fitment benefit (% of BP +DA) |

|

I |

More than 20% but upto 30% of average PBT of last 3 FYs |

10% |

|

II |

More than 30% but upto 40% of average PBT of last 3 FYs |

5% |

No fitment or any other benefit of pay revision will be implemented in the CPSEs where the additional financial impact of the revised pay package is more than 40% of the average PBT of last 3financial years.

iii. At the time of implementation of pay revision, if the additional financial impact after allowing full / part fitment exceeds 20% of the average PBT of last 3 years, then PRP payout / allowances should be reduced so as to restrict impact of pay revision within 20%.

iv. Subsequent to implementation of pay revision, the profitability of a CPSE would be reviewed after every 3 years and

a. if there is improvement in the average PBT of the last 3 years, then full pay package/ higher stage of pay package would be implemented while ensuring that total additional impact (sum total of previously implemented part pay package and proposed additional package) stays within 20% of the average of PBT of last 3 years

b. if the profitability of a CPSE falls in such a way that the earlier pay revision now entails impact of more than 20% of average PBT of last 3 year, then PRP/ allowances will have to be reduced to bring down impact

3. Methodology for pay fixation:

To arrive at the revised Basic Pay as on 1.1.2017 fitment methodology shall be as under:

|

A |

|

B |

|

C |

|

D on 1.1.2017] * |

|

Basic Pay + |

+ |

Industrial Dearness |

+ |

15% |

= |

Aggregate |

|

Stagnation |

|

Allowance (IDA) @119.5% as |

|

/10%/5% |

|

amount rounded |

|

increment(s) as on 31.12.2016 (Personal Pay / Special Pay not to be included) |

|

applicable on 1.1.2017 [under the IDA pattern computation methodology linked to All India Cumulative Price Index (AICPI) 2001=100 series] |

|

of (A+B) |

|

off to the next Rs.10/-. |

* In case revised BP as on 1. 1.2017 arrived so is less than the minimum of the revised pay scale, pay will be fixed at the minimum of the revised pay scale.

4. Pay revision in respect of Non-unionized Supervisors of CPSEs: The revision of scales of pay for Non-unionized Supervisory staff would be decided by the respective Board of Directors.

5. The applicability of affordability clause in respect of certain types of CPSEs is given at Annexure II

6. Increment:- A uniform rate of 3% of BP will be applicable for both annual increment as well as promotion increment. The details regarding Stagnation Increment and Bunching of pay are given at Annexure-III (A)

7. Dearness Allowance: 100% DA neutralization would be continued for all the executives and non-unionised supervisors, who are on IDA pattern of scales of pay w.e.f. 01.01.2017. Thus, DA as on 01.01.2017 will become zero with link point of All India Consumer Price Index (AICPI) 2001=100, which is 277.33 (Average of AICPI for the months of September, October & November, 2016) as on 01.01.2017. The periodicity of adjustment will be once in three months as per the existing practice.

The quarterly DA payable from 01.01.2017 will be as per new DA given at Annexure-III(B).

8. House Rent Allowance (HRA)/ Lease Accommodation and House Rent Recovery (HRR): Separate guidelines would be issued later on these allowances. Till then, the existing allowance at the existing rate may be continued to be paid at pre-revised pay scales.

9. Perks & Allowances: The Board of Directors of CPSEs are empowered to decide on the perks and allowance admissible to the different categories of the executives, under the concept of ‘Cafeteria Approach’, subject to a ceiling of 35% of BP. Under the concept of ‘Cafeteria Approach’ the executives are allowed to choose from a set of perks and allowances. The recurring cost incurred on running and maintaining of infrastructure facilities like hospitals, colleges, schools etc. would be outside the ceiling of 35% of BP. As regards company owned accommodation provided to executives, CPSEs would be allowed to bear the Income Tax liability on the ‘non-monetary perquisite’ of which 50% shall be loaded within the ceiling of 35% of BP on perks and allowances.

10. Certain other perks & Allowances: Separate guidelines would be issued on location based Compensatory Allowance, Work based Hardship Duty Allowances and Non-Practicing Allowance. Till then the existing allowances at the existing rate would continue to be paid at the pre-revised pay scales.

11. Performance Related Pay (PRP):- The admissibility, quantum and procedure for determination of PRP has been given in Annexure- IV. The PRP model will be effective from FY 2017-18 and onwards. For the FY 2017-18, the incremental profit will be based on previous FY 2016-17. The PRP model will be applicable only to those CPSEs which sign Memorandum of Understanding (MOU), and have a Remuneration Committee (headed by an Independent Director) in place to decide on the payment of PRP within the prescribed limits and guidelines.

12.Superannuation Benefits: The existing provisions regarding superannuation benefits have been retained as per which CPSEs can contribute upto 30% of BP plus DA towards Provident Fund (PF), Gratuity, Post-Superannuation Medical Benefits (PRMB) and Pension of their employees.

12.1 The ceiling of gratuity of the executives and non-unionised supervisors of the CPSEs would be raised from Rs 10 lakhs to Rs 20 lakhs with effect from 01.01.2017 and the funding for the entire amount of Gratuity would be met from within the ceiling of 30% of BP plus DA. Besides, the ceiling of gratuity shall increase by 25% whenever IDA rises by 50%.

12.2 The existing requirement of superannuation and of minimum of 15 years of service in the CPSE has been dispensed with for the pension.

12.3 The existing Post-Retirement Medical Benefits will continue to be linked to requirement of superannuation and minimum of 15 years of continuous service for other than Board level Executives. The Post-Retirement medical benefits shall be allowed to Board level executives (without any linkage to provision of 15 years of service) upon completion of their tenure or upon attaining the age of retirement, whichever is earlier

13 . Corpus for medical benefits for retirees of CPSEs: The corpus for post — retirement medical benefits and other emergency needs for the employees of CPSEs who have retired prior to 01.01.2007 would be created by contributing the existing ceiling of 1.5% of PBT. The formulation of suitable scheme in this regard by CPSEs has to be ensured by the administrative Ministries/Departments.

14. Club Membership: The CPSEs will be allowed to provide Board level executives with the Corporate Club membership (upto maximum of two clubs), co-terminus with their tenure.

15.Leave regulations/management: CPSEs would be allowed to frame their own leave management policies and the same can be decided based on CPSEs operational and administrative requirements subject to the principles that:

a.Maximum accumulation of Earned Leave available are not permitted beyond 300 days for an employee of CPSE. The same shall not be permitted for encashment beyond 300 days at the time of retirement.

b. CPSEs should adopt 30 day’s month for the purpose of calculating leave

c.Casual and Restricted Leave will continue to be lapsed at the end of the calendar year.

16. Periodicity: The next pay revision would take place in line with the periodicity as decided for Central Government employees but not later than 10

17. Financial Implications: Expenditure on account of pay revision is to be entirely borne by the CPSEs out of their earnings and no budgetary support will be provided by the Government.

18. Issue of Presidential directive, effective Date of implementation and payment of allowances. The revised pay scales will be effective from 01.2017(except the allowances mentioned in the paras 8 and 10 above). The Board of Directors of each CPSE would be required to consider the proposal of pay revision based on their affordability to pay, and submit the same to the administrative Ministry for approval. The administrative Ministry concerned will issue the Presidential Directive with the concurrence of its Financial Adviser in respect of each CPSE separately. Similarly presidential directives would be issued by the administrative Ministry concerned based on the result of review which is to be done after every 3 years subsequent to implementation. A copy of the Presidential Directives, issued by the administrative Ministry/Department concerned may be endorsed to the Department of Public Enterprises.

19. Issue of instructions/clarification and provision of Anomalies Committee: The Department of Public Enterprises (DPE) will issue necessary instructions/clarifications wherever required, for implementation of the above An Anomalies Committee consisting of Secretaries of Department of Public Enterprises (DPE), Department of Expenditure and Department of Personnel & Training is being constituted for a period of two years to look into further specific issues/problems that may arise in implementation of the Government’s Decision on 3rd pay pay revision. Any anomaly should be forwarded with the approval of Board of Directors to the administrative Ministry/Department who will examine the same and dispose of the same. However, if it is not possible for the administrative Ministry/Department to sort out the issue, they may refer the matter to DPE, with their views for consideration of the Anomalies Committee.

(Rajesh Kumar Chaudhry)

Joint Secretary to the Government of India

Annexure-I

(Para 2 )

|

Grade |

Existing(Rs) |

Revised(Rs) |

|

EO |

12600-32500 |

30000-120000 |

|

E 1 |

16400-40500 |

40000-140000 |

|

E2 |

20600-46500 |

50000-160000 |

|

E3 |

24900-50500 |

60000-180000 |

|

E4 |

29100-54500 |

70000-200000 |

|

E5 |

32900-58000 |

80000-220000 |

|

E6 |

36600-62000 |

90000-240000 |

|

E7 |

43200-66000 |

100000-260000 |

|

E8 |

51300-73000 |

120000-280000 |

|

E9 |

62000-80000 |

150000-300000 |

|

Grade |

Existing(Rs) |

Revised(Rs) |

|

Director(Sch-D) |

43200-66000 |

100000-260000 |

|

CMD(D) |

51300-73000 |

120000-280000 |

|

Director(Sch-C) |

51300-73000 |

120000-280000 |

|

CMD(C) |

65000-75000 |

160000-290000 |

|

Director(Sch-B) |

65000-75000 |

160000-290000 |

|

CMD(B) |

75000-90000 |

180000-320000 |

|

Director(Sch-A) |

75000-100000 |

180000-340000 |

|

CMD(A) |

80000-125000 |

200000-370000 |

*E7 only in CPSEs of Schedule A, B & C

*E8 only in CPSEs of Schedule A & B

*E9 only in CPSEs of Schedule A

Annexure II

(Para 5)

Affordability to certain types of CPSEs:

a.In respect of Sick CPSEs referred to erstwhile Board for Industrial and Financial Reconstruction (BIFR) / Appellate Authority for Industrial and Financial Reconstruction (AAIFR), the revision of pay scales should be in accordance with rehabilitation packages approved by the Government after providing for the additional expenditure on account of pay revision in these packages.

b.The affordability condition shall also be applicable to the CPSEs registered under Section 25 of the Companies Act, 1956, or under Section 8 of the Companies Act, 2013 (which by the very nature of their business are not-for profit companies) for implementation of the revised compensation structure (including Performance Related Pay) as being recommended for other CPSEs.

c.There are also certain CPSEs which have been formed as independent Government companies under a statute to perform a specific agenda / regulatory The revenue stream of such CPSEs are not linked to profits from the open market in a competitive scenario but are governed through the fees & charges, as prescribed and amended from time to time by the Government. There is no budgetary support provided by the Government to such CPSEs. In consideration that the impact of the revised compensation structure (including Performance Related Pay) would supposedly form the part of revenue stream for such CPSEs, the affordability condition shall not be applicable to these CPSEs; however the implementation of same shall be subject to the approval of Administrative Ministry upon agreeing and ensuring to incorporate the impact of the revised compensation structure into the revenue stream.

d.As regards the CPSEs under construction which are yet to start their commercial operations, the implementation of pay-revision would be decided by the Government based on the proposal of concerned Administrative Ministry and after consideration of their financial viability.

e. In case of Coal India Limited (CIL), the holding company and its subsidiaries would be considered as a single unit for the affordability clause as per past

Annexure-Ill (A)

(Para 6)

Stagnation Increment: In case of reaching the end point of pay scale, an executive would be allowed to draw stagnation increment, one after every two years upto a maximum of three such increments provided the executives gets a performance rating of ‘Good’ or above.

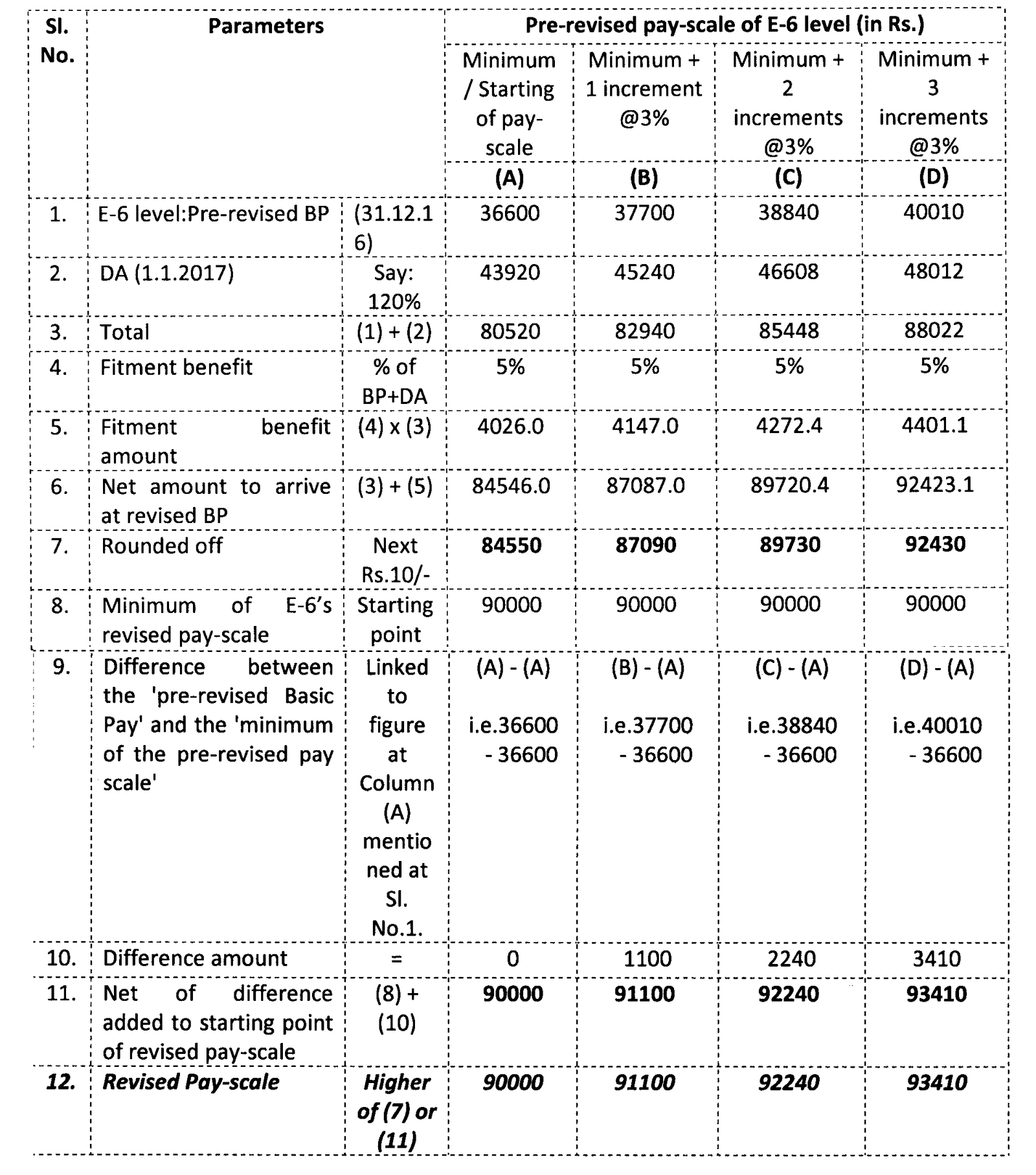

Bunching of Pay: – In CPSEs where a lower fitment benefit (i.e. 10% or 5%) is granted due to affordability, there is a possibility of bunching at different grades due to revised Basic Pay falling short of reaching starting point of revised pay-scale. The revised BP due to bunching of pay in these cases would be the higher of the followings –

- Adding the difference between the ‘pre-revised Basic Pay’ and ‘the minimum of the pre-revised pay scale’ to the starting point of revised pay scale.

- The revised BP as arrived after applying the fitment benefit (ie 10% or 5% of BP plus DA).

[Example for Basic Pay revision in cases of bunching in a Grade/level]

Annexure-III (B)

(Para 7)

Rates of Dearness Allowances for the employees of CPSEs following IDA pattern

|

Effective Date |

Rate of Dearness Allowance(in |

|

01.01.2017 |

0 |

|

01.04.2017 |

-1.1 |

|

01.07.2017 |

-0.2 |

Annexure-IV

(para 11)

Performance Related Pay

(I) Allocable profits:

a. The overall profits for distribution of PRP shall be limited to 5% of the year’s profit accruing only from core business activities (without consideration of interest on idle cash / bank balances), which will be exclusively for executives and for non-unionized supervisors of the CPSE. The ratio of break-up of profit accruing from core business activities for payment of PRP between relevant year’s profit to Incremental profit shall be 65:35 to arrive at the Allocable profits and the Kitty factor.

(I) PRP differentiator components:

(A) PRP payout is to be distributed based on the addition of following parts / components:-

Part-1 : CPSE’s performance component:-

a. Weightage = 50% of PRP payout

b. Based on CPSE’s MOU rating:

|

MOU rating |

%age eligibility of PRP |

|

Excellent |

100% |

|

Very Good |

75% |

|

Good |

50% |

|

Fair |

25% |

|

Poor |

Nil |

Part-2 : Team’s performance component:-

(a) Weightage = 30% of PRP payout

(b) Based on Team rating (i.e. linked to Plant / Unit’s productivity measures and operational / physical performance):

|

Team rating |

%age eligibility of PRP |

|

Excellent |

100% |

|

Very Good |

80% |

|

Good / Average |

60% |

|

Fair |

40% |

|

Poor |

Nil |

‘In case of a CPSE not having Plants/Units and if there is a no Team Performance areas/rating, then the PRP for such CPSE will be determined based specifically on MoU rating after merging the weightage of Team performance component to the Company’s performance component.

(c) The Team rating shall be linked to individual Plant / Unit’s productivity measures and operational / physical performance, as primarily derived from CPSEs’ MOU parameters and as identified by CPSE depending on the nature of industry / business under the following suggested performance areas:-

- ‘Achievement Areas’, in which performance has to be maximized (e.g. market shares, sales volume growth, product output / generation, innovations in design or operation, awards and other competitive recognition, etc.); and

- ‘Control Areas’ in which control has to be maximized (e.g. stock / fuel loss, operating cost control, litigation cost, safety, etc.).

(d) For office locations of CPSEs, the Team rating should be linked to the Plant / Unit as attached to the said office; and if there is more than one Plant / Unit attached to an office or in case of Head Office / Corporate Office of the CPSE, the Team rating shall be the weighted average of all such Plants / Units. The weighted average shall be based on the employee manpower strength of the respective Plants / Units.

[Plants/Units shall primarily mean the work place where industry’s manufacturing process is carried out and in case of a CPSE not having any manufacturing process, it shall mean the work place where the main business is carried out. The individual department/section within a work place shall not be recognized as a Plant/Unit].

Part-3 : Individual’s performance component:-

a. Weightage = 20% of PRP payout

b. Based on Individual performance rating (i.e. as per the CPSE’s Performance Management System):

|

Individual performance rating |

%age eligibility of |

|

Excellent |

100% |

|

Very Good |

80% |

|

Good / Average |

60% |

|

Fair |

40% |

|

Poor |

Nil |

The forced rating of 10% as below par / Poor performer shall not be made mandatory. Consequently, there shall be discontinuation of Bell-curve. The CPSEs are empowered to decide on the ratings to be given to the executives; however, capping of giving Excellent rating to not more than 15% of the total executive’s in the grade (at below Board level) should be adhered to.

(II) Percentage ceiling of PRP (%age of BP):

(a) The grade-wise percentage ceiling for drawal of PRP within the allocable profits has been rationalized as under:-

|

Grade |

Ceiling |

|

Eo |

40% |

|

E 1 |

40% |

|

E2 |

40% |

|

Es |

40% |

|

E4 |

50% |

|

E5 |

50% |

|

E6 |

60% |

|

E7 |

70% |

|

E8 |

80% |

|

E9 |

90% |

|

Director (C&D) |

100% |

|

Director (A&B) |

125% |

|

CMD / MD (C&D) |

125% |

|

CMD / MD (A&B) |

150% |

Note:

1.For Non- Unionized supervisors, the PRP as percentage of BP will be decided by the respective Board of Directors of the CPSE.

III ) Kitty factor: After considering the relevant year’s profit, incremental profit and the full PRP payout requirement (computed for all executives based on Grade-wise ceilings, CPSE’s MOU rating, Team rating & Individual performance rating), there will be two cut-off factors worked out based on the PRP distribution of 65:35. The first cut-off shall be in respect of PRP amount required out of year’s profit, and the second cut-off shall be in respect of PRP amount required out of incremental profit, which shall be computable based on the break-up of allocable profit (i.e. year’s 5% of profit bifurcated into the ratio of 65:35 towards year’s profit and incremental profit).

The sum of first cut-off factor applied on 65% of Grade PRP ceiling and the second cut-off factor applied on 35% of Grade PRP ceiling will result in Kitty factor. The Kitty factor shall not exceed 100%.

IV) Based on the PRP components specified above, the PRP pay-out to the executives should be computed upon addition of the following three elements:-

a.Factor-X (% of BP):

Weightage of 50% Multiplied with Part-1 (CPSE’s MOU rating) Multiplied with Kitty factor

b.Factor-Y (% of BP):

Weightage of 30% Multiplied with Part-2 (Team’s performance) Multiplied with Kitty factor.

c.Factor-Z (% of BP):

Weightage of 20% Multiplied with Part-3 (Individual’s performance) Multiplied with Kitty factor.

d.Net PRP= Factor X + Factor Y + Factor Z =Net %age of Annual BP

EXAMPLES

Performance Related Pay (PRP): Examples for calculating Kitty factor/Allocable profit

- PRP Kitty Distribution: within 5% of profit accruing from core business activities (hereinafter, for brevity, referred to as Profit).

- Ratio of relevant year’s profit : incremental profit = 65 : 35

Example — 1:

|

SI. |

Parameters |

Amount (Rs.)/ %age |

|

1 |

FY 2016-17 |

Profit = 5000 crore |

|

2 |

FY 2017-18 for which PRP is to be distributed] |

Profit = 6000 crore |

|

3 |

Incremental profit |

1000 crore |

|

4 |

5% of the year’s profit |

300 crore |

|

5 |

Allocable profit out of current year’s 5% of profit based on distribution in the ratio of 65:35 towards the year’s profit and incremental profit: |

|

|

a. |

PRP payout from year’s profit |

195 crore [i.e. 65% out of 300 crore] |

|

b. |

PRP payout from incremental profit |

105 crore [i.e. 35% out of 300 crore]: [105 crore can be fully utilized as incremental profit is 1000 crore.] |

|

6 |

Full PRP Payout requirement (computed for all executives based on Grade-wise ceilings, CPSE’s MOU rating, Team rating & Individual performance rating) — but without applying kitty factor related to year’s profit or Incremental profit |

500 crore |

|

7 |

PRP payout break-up based on 65:35 distribution out of year’s profit and incremental profit: |

|

|

a |

PRP amount required out of year’s profit (i.e. 65% of Sl. No. 6) |

65% of 500 crore = 325 crore |

|

a l |

Cut-off factor(i) (in %age) for year’s PRP payout with reference to Sl. No. 5(a) & 7(a) |

195 crore / 325 crore = 60.00% |

|

b |

PRP amount required out of incremental profit (i.e. 35% of Sl. No. 6) |

35% of 500 crore = 175 crore |

|

bl |

Cut-off factor(2) (in %age) for incremental |

105 crore / 175 crore = 60.00% |

|

|

PRP payout with reference to Sl. No. 5(b) & 7(b) |

|

|

8 |

Thus, total Profit amount allocated for PRP distribution |

195 crore + 105 crore = 300 crore [i.e. 5% of Core business / operating profit] |

|

9 |

Kitty factor for respective Grade (in %age) |

[65% x Grade PRP ceiling (%) x |

PRP Payout to Individual Executives Example — 1 : For Grade E-1

Performance Related Pay (PRP): Examples for calculating Kitty factor/Allocable profit

a. PRP Kitty Distribution : within 5% of profit accruing from core business activities (hereinafter, for brevity, referred to as Profit).

b. Ratio of relevant year’s profit : incremental profit = 65 : 35

Example — 2:

PRP Payout to Individual Executives Example — 2 : For Grade E-4

[download id=””105094 template=”dlm-buttons-button”]